How has the emergence and expansion of OTT platforms affected the Indian audience?

We look at how the emergence of platforms such as Netflix and Disney+ Hotstar have changed the way India views television.

Introduction

The rise of OTT entertainment is challenging the existing supremacy of traditional television in India, with the emergence and rising popularity of multiple digital platforms liberating the second largest population in the world.

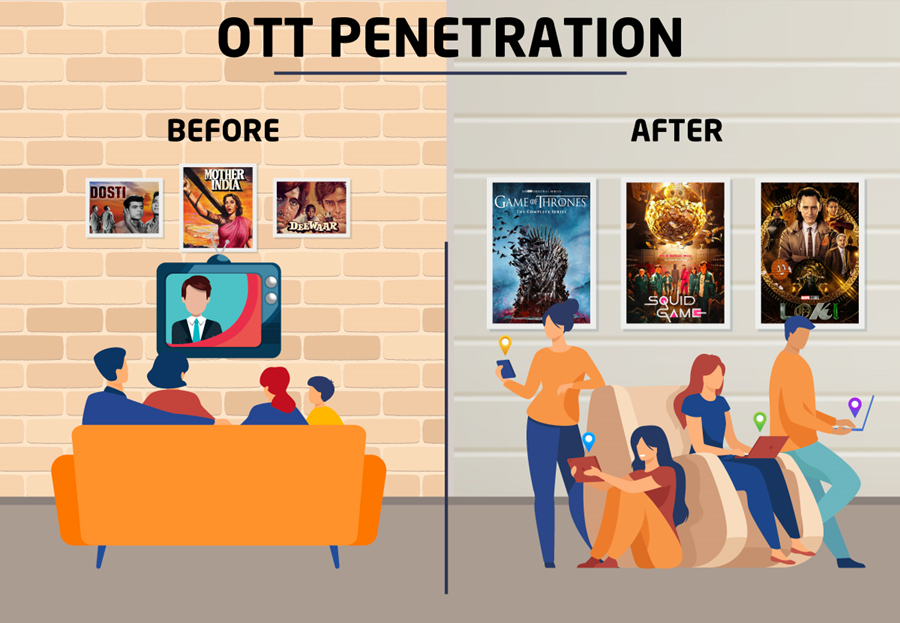

From Ramanand Sagar's Ramayana (1987) to Hwang Dong-hyuk's Squid Game (2021), the audience has witnessed a seismic shift in terms of content quality and quantity. The impact has forayed into different levels of society, with brand marketers even leveraging the in-trend OTT content to push engagement on digital media.

According to Consultancy.in, the size of the OTT market in minutes of consumption in India has risen from 181 billion to 204 billion minutes in 2021. There is no denying the fact that OTT is taking over. But what has led to this expansion, and how does it impact the highly diverse Indian audience? The Satta Matka team at Betway seeks to find out.

Viewership of OTT Platforms in India

Digitalisation has evolved rapidly in the past few years. The pandemic alone caused an enormous surge in the viewership of OTT platforms in India, while consumption of OTT content is highest in India among the 15-35 age group. According to a report generated by MICA’s Centre for Media and Entertainment Studies (CMES):

- India will experience a tremendous increase in OTT consumers by 2023. Currently, there are 350 million users, but it is projected to reach up to 500 million users.

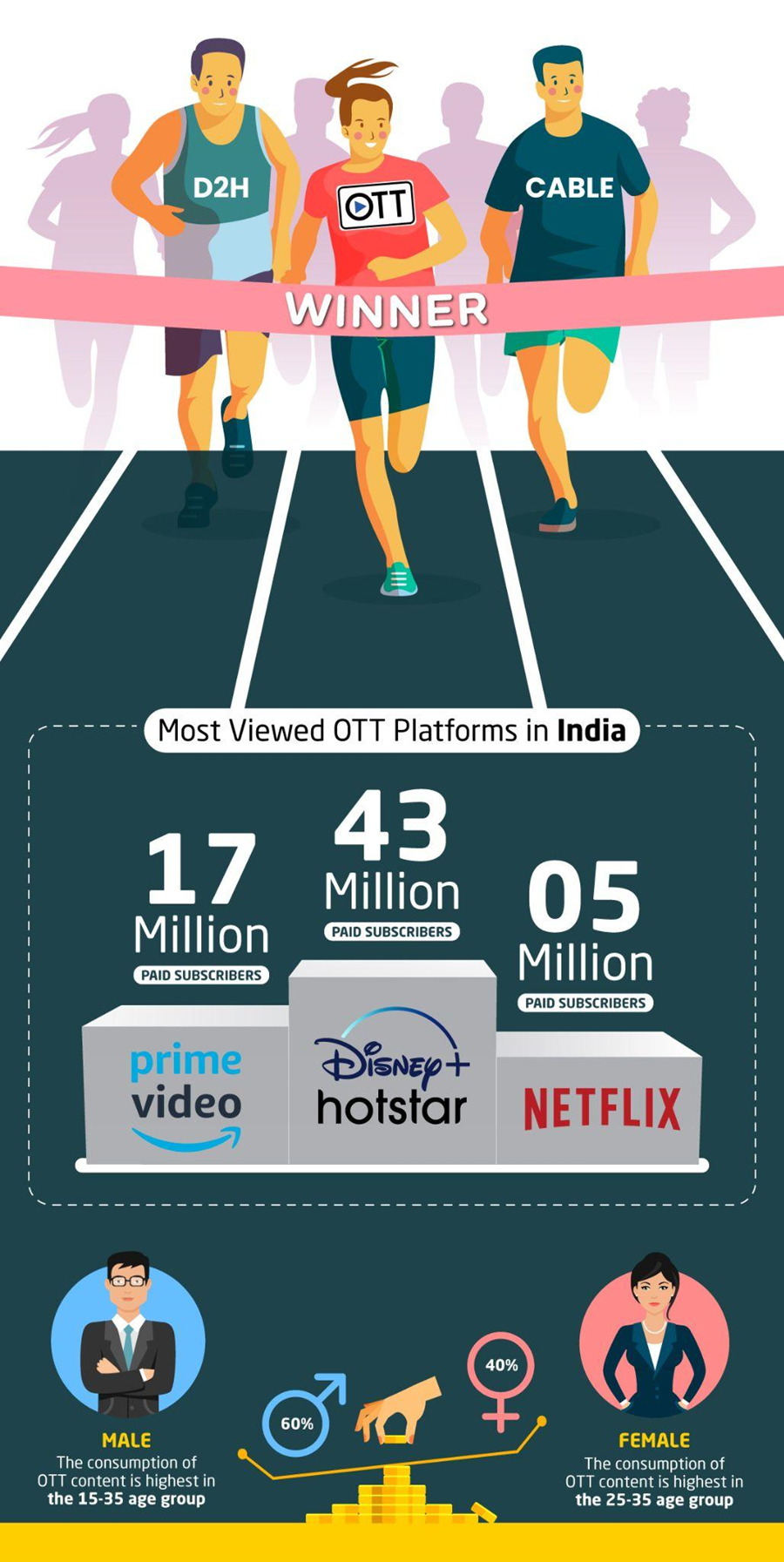

- Disney+ Hotstar has 43 million subscribers which makes it the most widespread OTT platform in India, followed by Amazon Prime with 17 million subscribers, and Netflix with 5 million subscribers.

- Hotstar has cornered the OTT market and holds 29 per cent of overall viewership. The platform’s revenue was around 16 billion Indian rupees in 2020.

- 85 per cent of Indian subscribers will be internet-ready by the end of 2023. The average age group of OTT paid subscribers is between 35-44 years.

- Capital of 1 billion USD is currently being invested in the OTT industry by many venture capitalists and business tycoons.

- The male audience has increased by twofold when compared to females recently.

- The prevalence of OTT platforms is the highest among the younger generation. Particularly, men in the age group 15-30 consume the most OTT content.

- Among women, the consumption of OTT content is highest in the 25-35 age group, and that number has increased during the pandemic. However, they contributed to less than 50 per cent of overall consumption when compared to men.

The Expansion

One of the major reasons for the proliferation of OTT on a global level is its convenience of use. All you need is a high-speed internet connection and a supported device. For India, however, the incredible journey of crossing five million Netflix subscribers was a bit bumpy. While urban areas were adequately familiar with the digital world, rural pockets were still gasping for access. So, how did the expansion proceed? There were two main contributors:

- The rapid expansion of smartphones and their use for digital consumption

- The advent of cheap high-speed internet from service providers like Reliance Jio

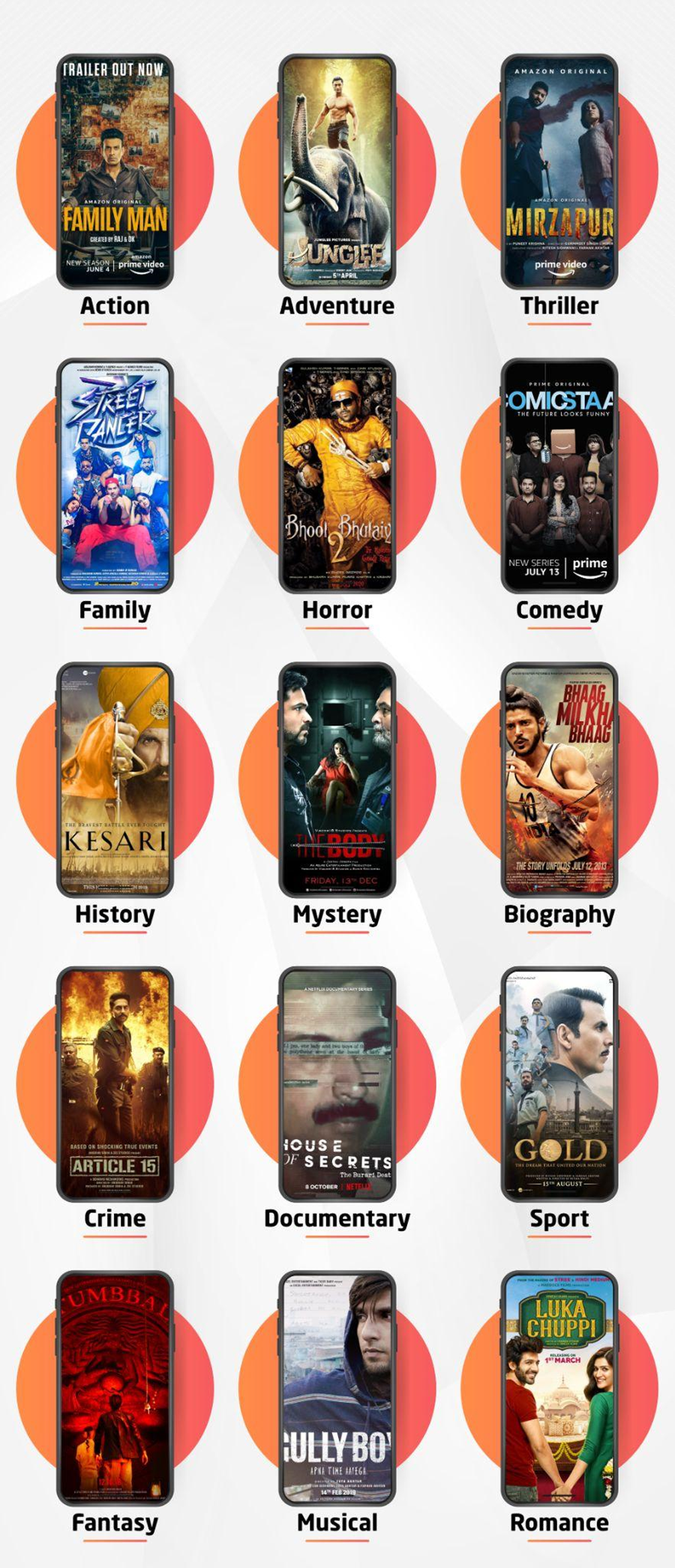

As smartphones reached the rural corners of the country, the adoption of OTT became more apparent. The impact saw the Indian audience gaining access to high-quality and diverse content that is compatible across devices. Platform developers and producers, on the other hand, started realising the population potential. Even before Netflix put on its running shoes in India, domestic platforms like SonyLiv and Hotstar captured the audience with regional shows and live sports streaming.

The Impact on Age Groups

- Children have highly benefited from the volume of content available across platforms. The emergence of edutainment and free content on major OTT applications have allowed kids to entertain as well as educate themselves digitally.

- The youth constitute the largest audience of OTT in India. Entrepreneurs, as well as professionals, have adopted OTT as a part of the daily routine. The concept of 'Netflix and Chill' has made its way into the urban lifestyle, taking on the role of a friend and entertainer.

- The constant content updates on OTT platforms have come across as a boon to the older population in India. While couples are able to enjoy the hits of their time with their partner, those in solitude have access to a plethora of spiritual and religious content.

Urban vs Rural

From a broader viewpoint, the impact of OTT has been different on the rural and the urban population. According to Ascent Group India, around 65 per cent of OTT content consumption in India comes from the rural parts with only 40 per cent internet connection. This speaks volumes of the influence of regional language content on the population.

Content creators and platform developers have tapped into this potential by launching several original productions in languages like Hindi, Bangla, Tamil, Telugu, and more. The high demand for regional content has pulled channel providers such as KPMG Eros Now, Zee TV, and Sun TV to develop their own OTT platforms.

In the urban pockets of the country, parallel cinema enthusiasts have now got access to original international content beyond the limits of commercial western or Indian cinema. The high demand for off-beat narratives has even encouraged homegrown talent to produce and bring 'indie talent' to the forefront.

Catering to a market as humongous and diverse as India requires some fine tuning. The constant cry for 'new content' and the ever-rising demand has implored even global players like Netflix and Amazon to tune their subscription charges. Netflix's INR 199 monthly mobile-only plan is the perfect example of the company's motive to capture the rural Indian audience.

Summing Up

The expansion of OTT in the field of edutainment, health, and fitness has further solidified its future. It has opened fresh avenues for content creators, and the Indian audience has started perceiving it as more than just a medium of entertainment. It has become a friend to the lonely and a mentor to the young.

However, the lack of regulation on OTT is still seen as a major concern in the typical Indian household. Parents being unable to restrict their children from consuming 18+ content is frowned upon in society.

While efforts are being made to try and regulate OTT in India, one thing is for sure: OTT will continue to transform society and will have an even more significant impact in the coming years.